Tax Sale app for iPhone and iPad

Developer: VisualGov Solutions LLC

First release : 22 Apr 2013

App size: 14.72 Mb

VisualGov provides an innovative approach to the Online Tax Sale for Florida counties with a mobile app solution that facilitates the bidding process.

Florida Statutes require the tax collector to conduct a tax certificate sale beginning on or before June 1st for the preceding year of delinquent real estate taxes.

On the advertised day and time, the tax collector auctions and sells a tax certificate on each delinquent parcel of real property.

The issuance of tax certificates and the auction process is governed by Chapter 197 of the Florida Statutes.

Tax certificates convey no property rights. They are an interest bearing "lien".

The interest on a tax certificate ranges from zero (0) to 18% annually.

Valid bids may be entered between zero (0) and 18% in 0.25% increments.

The app supports the following Florida Counties:

1. Bay

2. Bradford

3. Desoto

4. Gulf

5. Hamilton

6. Hardee

7. Holmes

8. Jackson

9. Madison

10. Okeechobee

11. Wakulla

Key Features include:

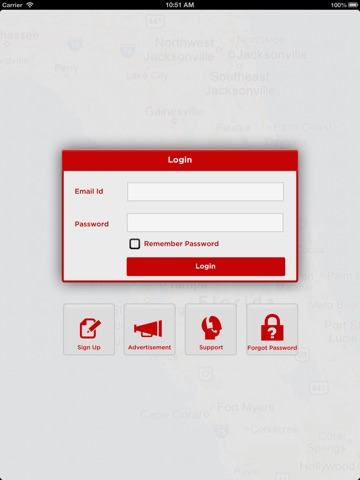

1. Registration and Sign-On

2. Place Bids

3. Search for certificates

4. Review Bids

5. Deposit funds

6. Complete a W9 Form

Security:

1. All application requests and transactions are routed through secure servers

2. The mobile application does not transmit or use any sensitive personal information

3. All network traffic between the mobile device and the server is encrypted

4. Username and password protected

Learn More:

Please visit the following website to learn more about the Florida Tax Sale Solutions application: http://www.flataxsales.com